19. The Hopenhayn Entry-Exit Model#

GPU

This lecture was built using a machine with access to a GPU — although it will also run without one.

Google Colab has a free tier with GPUs that you can access as follows:

Click on the “play” icon top right

Select Colab

Set the runtime environment to include a GPU

19.1. Outline#

The Hopenhayn (1992, ECMA) entry-exit model is a highly influential (partial equilibrium) heterogeneous agent model where

the agents receiving idiosyncratic shocks are firms, and

the model produces a non-trivial firm size distribution and a range of predictions for firm dynamics.

We are going to study an extension of the basic model that has unbounded productivity.

Among other things, this allows us to match the heavy tail observed in the firm size distribution data.

In addition to what’s in Anaconda, this lecture will need the following libraries:

!pip install quantecon

We will use the following imports.

import jax.numpy as jnp

import jax

import quantecon as qe

import matplotlib.pyplot as plt

from collections import namedtuple

19.2. The Model#

19.2.1. Environment#

There is a single good produced by a continuum of competitive firms.

The productivity \(\varphi_t = \varphi_t^i\) of each firm evolves randomly on \(\mathbb R_+\).

the \(i\) superscript indicates the \(i\)-th firm and we drop it in what follows

A firm with productivity \(\varphi\) facing output price \(p\) and wage rate \(w\) earns current profits

Here

\(\theta \in (0,1)\) is a productivity parameter,

\(c\) is a fixed cost and

\(n\) is labor input.

Maximizing over \(n\) leads to

where \(\eta := 1/(1-\theta)\).

Output is

Productivity of incumbents is independent across firms and grows according to

Here \(\Gamma\) is a Markov transition kernel, so that \(\Gamma(\varphi, d \varphi')\) is the distribution over \(\mathbb R_+\) given \(\varphi \in \mathbb R_+\).

For example,

New entrants obtain their productivity draw from a fixed distribution \(\gamma\).

Demand is

19.2.2. Firm decisions#

The intertemporal firm decision problem is choosing when to exit.

The timing is:

produce and receive current profits \(\pi(\varphi, p)\)

decide whether to continue or exit.

Scrap value is set to zero and the discount rate is \(\beta \in (0, 1)\).

The firm makes their stop-continue choice by first solving for the value function, which is the unique solution in a class of continuous functions \(\mathscr C\) (details omitted) to

Let \(\bar v\) be the unique solution to this functional equation.

Given \(\bar v\), we let \(\bar \varphi\) be the exit threshold function defined by

With the convention that incumbents who are indifferent remain rather than exit, an incumbent with productivity \(\varphi\) exits if and only if \(\varphi < \bar \varphi (p)\).

19.2.3. Equilibrium#

Now we describe a stationary recursive equilibrium in the model, where

the goods market clears (supply equals demand)

the firm size distribution is stationary over time (an invariance condition)

the mass of entrants equals the mass of exiting firms, and

entering firms satisfy a break-even condition.

The break-even condition means that expected lifetime value given an initial draw from \(\gamma\) is just equal to the fixed cost of entry, which we denote by \(c_e\).

Let’s now state this more formally

To begin, let \(\mathscr B\) be the Borel subsets of \(\mathbb R_+\) and \(\mathscr M\) be all measures on \(\mathscr B\).

Taking \(\bar v\) and \(\bar \varphi\) as defined in the previous section, a stationary recursive equilibrium is a triple

with \(p\) understood as price, \(M\) as mass of entrants, and \(\mu\) as a distribution of firms over productivity levels, such that the goods market clears, or

the invariance condition over the firm distribution

holds (see below for intuition), the equilibrium entry condition

holds, and the balanced entry and exit condition

is verified.

The invariance condition says that, for any subset \(B\) of the state space, the mass of firms with productivity in set \(B\) today (the left-hand side) is equal to the mass of firms with productivity in set \(B\) tomorrow (the right-hand side).

19.2.4. Computing equilibrium#

We compute the equilibrium as follows:

For the purposes of this section, we insert balanced entry and exit into the time invariance condition, yielding

where \(\Pi\) is the transition kernel on \(\mathbb R_+\) defined by

Under our assumptions, for each \(p > 0\), there exists a unique \(\mu\) satisfying this invariance law.

Let \(\mathscr P\) be the probability measures on \(\mathbb R_+\).

The unique stationary equilibrium can be computed as follows:

Obtain \(\bar v\) as the unique solution to the Bellman equation, and then calculate the exit threshold function \(\bar \varphi\).

Solve for the equilibrium entry price \(p^*\) by solving the entry condition.

Define \(\Pi\) as above, using \(p^*\) as the price, and compute \(\mu\) as the unique solution to the invariance condition.

Rescale \(\mu\) by setting \(s := D(p^*)/ \int q( \varphi, p^*) \mu(d \varphi)\) and then \(\mu^* := s \, \mu\).

Obtain the mass of entrants via \(M^* = \mu^* \{ \varphi < \bar \varphi(p^*) \}\).

When we compute the distribution \(\mu\) in step 3, we will use the fact that it is the stationary distribution of the Markov transition kernel \(\Pi(\varphi, d \varphi)\).

This transition kernel turns out to be ergodic, which means that if we simulate a cross-section of firms according to \(\Pi\) for a large number of periods, the resulting sample (cross-section of productivities) will approach a set of IID draws from \(\mu\).

This allows us to

compute integrals with respect to the distribution using Monte Carlo, and

investigate the shape and properties of the stationary distribution.

19.2.5. Specification of dynamics#

Before solving the model we need to specify \(\Gamma\) and \(\gamma\).

We assume \(\Gamma(\varphi, d \varphi')\) is given by

We assume that \((A_t)\) is IID over time, independent across firms, and lognormal \(LN(m_a, \sigma_a)\).

(This means that incumbents follow Gibrat’s law, which is a reasonable assumption for medium to large firms – and hence for incumbents.)

New entrants are drawn from a lognormal distribution \(LN(m_e, \sigma_e)\).

19.3. Code#

We use 64 bit floats for extra precision.

jax.config.update("jax_enable_x64", True)

We store the parameters, grids and Monte Carlo draws in a namedtuple.

Parameters = namedtuple("Parameters",

("β", # discount factor

"θ", # labor productivity

"c", # fixed cost in production

"c_e", # entry cost

"w", # wages

"m_a", # productivity shock location parameter

"σ_a", # productivity shock scale parameter

"m_e", # new entrant location parameter

"σ_e")) # new entrant scale parameter

Grids = namedtuple("Grids",

("φ_grid", # productivity grid

"E_draws", # entry size draws for Monte Carlo

"A_draws")) # productivity shock draws for Monte Carlo

Model = namedtuple("Model",

("parameters", # instance of Parameters

"grids")) # instance of Grids

def create_model(β=0.95, # discount factor

θ=0.3, # labor productivity

c=4.0, # fixed cost in production

c_e=1.0, # entry cost

w=1.0, # wages

m_a=-0.012, # productivity shock location parameter

σ_a=0.1, # productivity shock scale parameter

m_e=1.0, # new entrant location parameter

σ_e=0.2, # new entrant scale parameter

φ_grid_max=5, # productivity grid max

φ_grid_size=100, # productivity grid size

E_draw_size=200, # entry MC integration size

A_draw_size=200, # prod shock MC integration size

seed=1234): # Seed for MC draws

"""

Create an instance of the `namedtuple` Model using default parameter values.

"""

# Test stability

assert m_a + σ_a**2 / (2 * (1 - θ)) < 0, "Stability condition fails"

# Build grids and initialize random number generator

φ_grid = jnp.linspace(0, φ_grid_max, φ_grid_size)

key, subkey = jax.random.split(jax.random.PRNGKey(seed))

# Generate a sample of draws of A for Monte Carlo integration

A_draws = jnp.exp(m_a + σ_a * jax.random.normal(key, (A_draw_size,)))

# Generate a sample of draws from γ for Monte Carlo

E_draws = jnp.exp(m_e + σ_e * jax.random.normal(subkey, (E_draw_size,)))

# Build namedtuple and return

parameters = Parameters(β, θ, c, c_e, w, m_a, σ_a, m_e, σ_e)

grids = Grids(φ_grid, E_draws, A_draws)

model = Model(parameters, grids)

return model

Let us write down functions for profits and output.

@jax.jit

def π(φ, p, parameters):

""" Profits. """

# Unpack

β, θ, c, c_e, w, m_a, σ_a, m_e, σ_e = parameters

# Compute profits

return (1 - θ) * (p * φ)**(1/(1 - θ)) * (θ/w)**(θ/(1 - θ)) - c

@jax.jit

def q(φ, p, parameters):

""" Output. """

# Unpack

β, θ, c, c_e, w, m_a, σ_a, m_e, σ_e = parameters

# Compute output

return φ**(1/(1 - θ)) * (p * θ/w)**(θ/(1 - θ))

Let’s write code to simulate a cross-section of firms given a particular value for the exit threshold (rather than an exit threshold function).

Firms that exit are immediately replaced by a new entrant, drawn from \(\gamma\).

Our first function updates by one step

def update_cross_section(φ_bar, φ_vec, key, parameters, num_firms):

# Unpack

β, θ, c, c_e, w, m_a, σ_a, m_e, σ_e = parameters

# Update

Z = jax.random.normal(key, (2, num_firms)) # long rows for row-major arrays

incumbent_draws = φ_vec * jnp.exp(m_a + σ_a * Z[0, :])

new_firm_draws = jnp.exp(m_e + σ_e * Z[1, :])

return jnp.where(φ_vec >= φ_bar, incumbent_draws, new_firm_draws)

update_cross_section = jax.jit(update_cross_section, static_argnums=(4,))

Our next function runs the cross-section forward in time sim_length periods.

def simulate_firms(φ_bar, parameters, grids,

sim_length=200, num_firms=1_000_000, seed=12):

"""

Simulate a cross-section of firms when the exit threshold is φ_bar.

"""

# Set initial conditions to the threshold value

φ_vec = jnp.ones((num_firms,)) * φ_bar

key = jax.random.PRNGKey(seed)

# Iterate forward in time

for t in range(sim_length):

key, subkey = jax.random.split(key)

φ_vec = update_cross_section(φ_bar, φ_vec, subkey, parameters, num_firms)

return φ_vec

Here’s a utility function to compute the expected value

given \(\varphi\)

@jax.jit

def _compute_exp_value_at_phi(v, φ, grids):

"""

Compute

E[v(φ')| φ] = Ev(A φ)

using linear interpolation and Monte Carlo.

"""

# Unpack

φ_grid, E_draws, A_draws = grids

# Set up V

Aφ = A_draws * φ

vAφ = jnp.interp(Aφ, φ_grid, v) # v(A_j φ) for all j

# Return mean

return jnp.mean(vAφ) # (1/n) Σ_j v(A_j φ)

Now let’s vectorize this function in \(\varphi\) and then write another function that computes the expected value across all \(\varphi\) in φ_grid

compute_exp_value_at_phi = jax.vmap(_compute_exp_value_at_phi, (None, 0, None))

@jax.jit

def compute_exp_value(v, grids):

"""

Compute

E[v(φ_prime)| φ] = Ev(A φ) for all φ, as a vector

"""

# Unpack

φ_grid, E_draws, A_draws = grids

return compute_exp_value_at_phi(v, φ_grid, grids)

Here is the Bellman operator \(T\).

@jax.jit

def T(v, p, parameters, grids):

""" Bellman operator. """

# Unpack

β, θ, c, c_e, w, m_a, σ_a, m_e, σ_e = parameters

φ_grid, E_draws, A_draws = grids

# Compute Tv

EvAφ = compute_exp_value(v, grids)

return π(φ_grid, p, parameters) + β * jnp.maximum(0.0, EvAφ)

The next function takes \(v, p\) as inputs and, conditional on the value function \(v\), computes the value \(\bar \varphi(p)\) that corresponds to the exit value.

@jax.jit

def get_threshold(v, grids):

""" Compute the exit threshold. """

# Unpack

φ_grid, E_draws, A_draws = grids

# Compute exit threshold: φ such that E v(A φ) = 0

EvAφ = compute_exp_value(v, grids)

i = jnp.searchsorted(EvAφ, 0.0)

return φ_grid[i]

We use value function iteration (VFI) to compute the value function \(\bar v(\cdot, p)\), taking \(p\) as given.

VFI is relatively cheap and simple in this setting.

@jax.jit

def vfi(p, v_init, parameters, grids, tol=1e-6, max_iter=10_000):

"""

Implement value function iteration to solve for the value function.

"""

# Unpack

φ_grid, E_draws, A_draws = grids

# Set up

def cond_function(state):

i, v, error = state

return jnp.logical_and(i < max_iter, error > tol)

def body_function(state):

i, v, error = state

new_v = T(v, p, parameters, grids)

error = jnp.max(jnp.abs(v - new_v))

i += 1

return i, new_v, error

# Loop till convergence

init_state = 0, v_init, tol + 1

state = jax.lax.while_loop(cond_function, body_function, init_state)

i, v, error = state

return v

@jax.jit

def compute_net_entry_value(p, v_init, parameters, grids):

"""

Returns the net value of entry, which is

\int v_bar(φ, p) γ(d φ) - c_e

This is the break-even condition for new entrants. The argument

v_init is used as an initial condition when computing v_bar for VFI.

"""

c_e = parameters.c_e

φ_grid = grids.φ_grid

E_draws = grids.E_draws

v_bar = vfi(p, v_init, parameters, grids)

v_φ = jnp.interp(E_draws, φ_grid, v_bar)

Ev_φ = jnp.mean(v_φ)

return Ev_φ - c_e, v_bar

We need to solve for the equilibrium price, which is the \(p\) satisfying

At each price \(p\), we need to recompute \(\bar v(\cdot, p)\) and then take the expectation.

The technique we will use is bisection.

We will write our own bisection routine because, when we shift to a new price, we want to update the initial condition for value function iteration to the value function from the previous price.

def compute_p_star(parameters, grids, p_min=1.0, p_max=2.0, tol=10e-5):

"""

Compute the equilibrium entry price p^* via bisection.

Return both p* and the corresponding value function v_bar, which is

computed as a byproduct.

Implements the bisection root finding algorithm to find p_star

"""

φ_grid, E_draws, A_draws = grids

lower, upper = p_min, p_max

v_bar = jnp.zeros_like(φ_grid) # Initial condition at first price guess

while upper - lower > tol:

mid = 0.5 * (upper + lower)

entry_val, v_bar = compute_net_entry_value(mid, v_bar, parameters, grids)

if entry_val > 0: # Root is between lower and mid

lower, upper = lower, mid

else: # Root is between mid and upper

lower, upper = mid, upper

p_star = 0.5 * (upper + lower)

return p_star, v_bar

We are now ready to compute all elements of the stationary recursive equilibrium.

def compute_equilibrium_prices_and_quantities(model):

"""

Compute

1. The equilibrium outcomes for p*, v* and φ*, where φ* is the

equilibrium exit threshold φ_bar(p*).

1. The scaling factor necessary to convert the stationary probability

distribution μ into the equilibrium firm distribution μ* = s μ.

2. The equilibrium mass of entrants M* = μ*{ φ < φ*}

"""

# Unpack

parameters, grids = model

# Compute prices and values

p_star, v_bar = compute_p_star(parameters, grids)

# Get φ_star = φ_bar(p_star), the equilibrium exit threshold

φ_star = get_threshold(v_bar, grids)

# Generate an array of draws from μ, the normalized stationary distribution.

φ_sample = simulate_firms(φ_star, parameters, grids)

# Compute s to scale μ

demand = 1 / p_star

pre_normalized_supply = jnp.mean(q(φ_sample, p_star, parameters))

s = demand / pre_normalized_supply

# Compute M* = μ*{ φ < φ_star}

m_star = s * jnp.mean(φ_sample < φ_star)

# return computed objects

return p_star, v_bar, φ_star, φ_sample, s, m_star

19.4. Solving the model#

19.4.1. Preliminary calculations#

Let’s create an instance of the model.

model = create_model()

parameters, grids = model

Let’s see how long it takes to compute the value function at a given price from a cold start.

p = 2.0

v_init = jnp.zeros_like(grids.φ_grid) # Initial condition

%time v_bar = vfi(p, v_init, parameters, grids).block_until_ready()

CPU times: user 434 ms, sys: 26.9 ms, total: 461 ms

Wall time: 548 ms

Let’s run the code again to eliminate compile time.

%time v_bar = vfi(p, v_init, parameters, grids).block_until_ready()

CPU times: user 56.8 ms, sys: 644 μs, total: 57.4 ms

Wall time: 56 ms

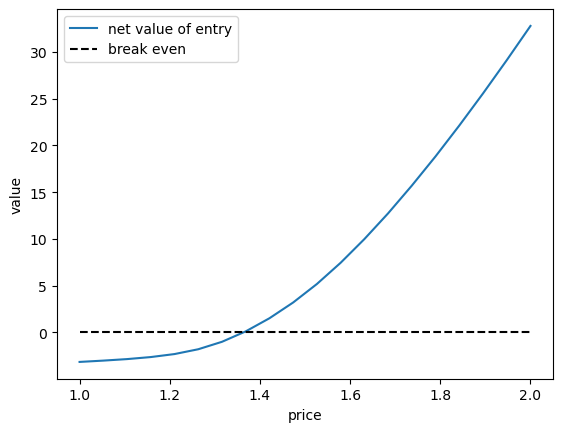

Let’s have a look at the net entry value as a function of price

The root is the equilibrium price at the given parameters

p_min, p_max, p_size = 1.0, 2.0, 20

p_vec = jnp.linspace(p_min, p_max, p_size)

entry_vals = []

v_bar = jnp.zeros_like(grids.φ_grid) # Initial condition at first price guess

for i, p in enumerate(p_vec):

entry_val, v_bar = compute_net_entry_value(p, v_bar, parameters, grids)

entry_vals.append(entry_val)

fig, ax = plt.subplots()

ax.plot(p_vec, entry_vals, label="net value of entry")

ax.plot(p_vec, jnp.zeros_like(p_vec), 'k', ls='--', label="break even")

ax.legend()

ax.set_xlabel("price")

ax.set_ylabel("value")

plt.show()

Below we solve for the zero of this function to calculate \(p*\).

From the figure it looks like \(p^*\) will be close to 1.5.

19.4.2. Computing the equilibrium#

Now let’s try computing the equilibrium

%%time

p_star, v_bar, φ_star, φ_sample, s, m_star = \

compute_equilibrium_prices_and_quantities(model)

CPU times: user 2.37 s, sys: 113 ms, total: 2.48 s

Wall time: 3.12 s

Let’s run the code again to get rid of compile time.

%%time

p_star, v_bar, φ_star, φ_sample, s, m_star = \

compute_equilibrium_prices_and_quantities(model)

CPU times: user 447 ms, sys: 31 ms, total: 478 ms

Wall time: 782 ms

Let’s check that \(p^*\) is close to 1.5

p_star

1.363800048828125

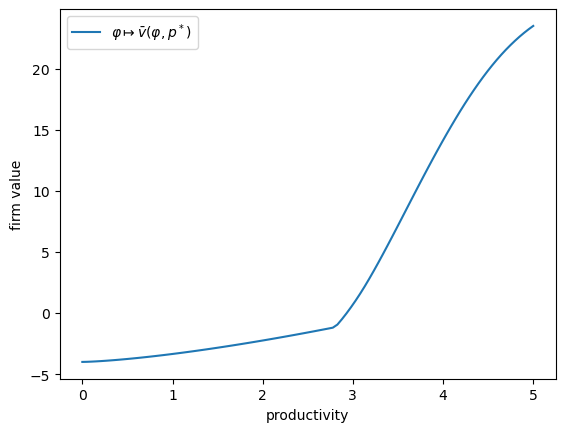

Here is a plot of the value function \(\bar v(\cdot, p^*)\).

fig, ax = plt.subplots()

ax.plot(grids.φ_grid, v_bar, label=r'$\varphi \mapsto \bar v(\varphi, p^*)$')

ax.set_xlabel("productivity")

ax.set_ylabel("firm value")

ax.legend()

plt.show()

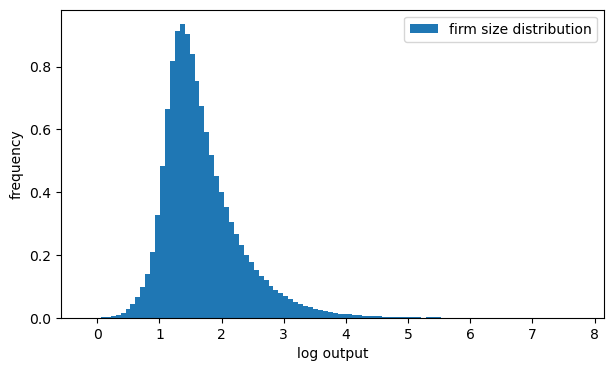

Let’s have a look at the firm size distribution, with firm size measured by output.

output_dist = q(φ_sample, p_star, parameters)

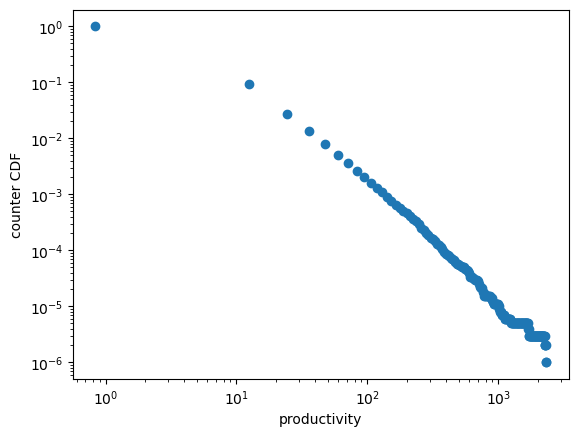

19.5. Pareto tails#

The firm size distribution shown above appears to have a long right tail.

This matches the observed firm size distribution.

In fact the firm size distribution obeys a power law.

More mathematically, the distribution of firm size has a Pareto right hand tail, so that there exist constants \(k, \alpha > 0\) with

Here \(\alpha\) is called the tail index.

Does the model replicate this feature?

One option is to look at the empirical counter CDF (cumulative distribution).

The idea is as follows: The counter CDF of a random variable \(X\) is

In the case of a Pareto tailed distribution we have \(\mathbb P\{X > x\} \approx k x^{-\alpha}\) for large \(x\).

Hence, for large \(x\),

The empirical counterpart of \(G\) given sample \(X_1, \ldots, X_n\) is

For large \(k\) (implying \(G_n \approx G\)) and large \(x\), we expect that, for a Pareto-tailed sample, \(\ln G_n\) is approximately linear.

Here’s a function to compute the empirical counter CDF:

def ECCDF(data):

"""

Return a function that implements the ECCDF given the data.

"""

def eccdf(x):

return jnp.mean(data > x)

return eccdf

Let’s plot the empirical counter CDF of the output distribution.

19.6. Exercise#

Exercise 19.1

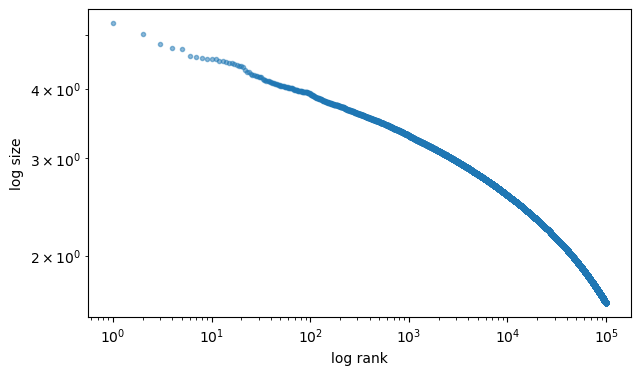

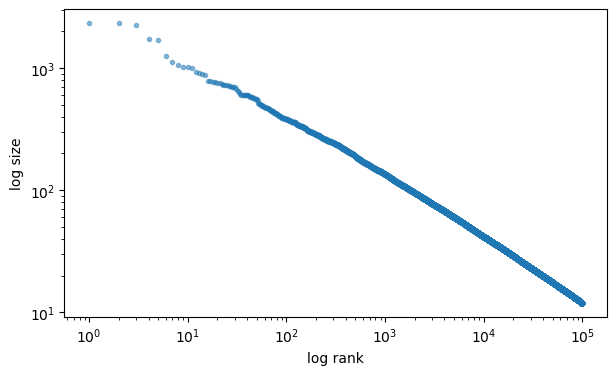

Plot the same output distribution, but this time using a rank-size plot.

If the rank-size plot is approximately linear, the data suggests a Pareto tail.

You can use QuantEcon’s rank_size function — here’s an example of usage.

x = jnp.abs(jax.random.normal(jax.random.PRNGKey(42), (1_000_000,)))

rank_data, size_data = qe.rank_size(x, c=0.1)

fig, ax = plt.subplots(figsize=(7,4))

ax.loglog(rank_data, size_data, "o", markersize=3.0, alpha=0.5)

ax.set_xlabel("log rank")

ax.set_ylabel("log size")

plt.show()

This plot is not linear — as expected, since we are using a folded normal distribution.

Solution

rank_data, size_data = qe.rank_size(output_dist, c=0.1)

fig, ax = plt.subplots(figsize=(7,4))

ax.loglog(rank_data, size_data, "o", markersize=3.0, alpha=0.5)

ax.set_xlabel("log rank")

ax.set_ylabel("log size")

plt.show()

This looks very linear — the model generates Pareto tails.

(In fact it’s possible to prove this.)

Exercise 19.2

As an exercise, let’s look at the fixed cost paid by incumbents each period and how it relates to the equilibrium price.

We expect that a higher fixed cost will reduce supply and hence increase the market price.

For the fixed costs, use

c_values = jnp.linspace(2.5, 5.0, 10)

Solution

eq_prices = []

for i, c in enumerate(c_values):

model = create_model(c=c)

p_star, v_bar, φ_star, φ_sample, s, m_star = \

compute_equilibrium_prices_and_quantities(model)

eq_prices.append(p_star)

print(f"Equilibrium price when c = {c:.2} is {p_star:.2}")

fig, ax = plt.subplots()

ax.plot(c_values, eq_prices, label="$p^*$")

ax.set_xlabel("fixed cost for incumbents")

ax.set_ylabel("price")

ax.legend()

plt.show()

Equilibrium price when c = 2.5 is 1.0

Equilibrium price when c = 2.8 is 1.1

Equilibrium price when c = 3.1 is 1.1

Equilibrium price when c = 3.3 is 1.2

Equilibrium price when c = 3.6 is 1.3

Equilibrium price when c = 3.9 is 1.3

Equilibrium price when c = 4.2 is 1.4

Equilibrium price when c = 4.4 is 1.5

Equilibrium price when c = 4.7 is 1.5

Equilibrium price when c = 5.0 is 1.6